Utah Standard Deduction 2022 . Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. Web utah has a single tax rate for all income levels, as follows: Officially, utah does not have standard deductions; Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. Web utah standard and itemized deductions. A listing of the utah individual income tax rates for various filing periods.

from cefpjdkt.blob.core.windows.net

Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. A listing of the utah individual income tax rates for various filing periods. Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Web utah has a single tax rate for all income levels, as follows: Officially, utah does not have standard deductions; Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. Web utah standard and itemized deductions.

Standard Deduction 2022 Business at Richard Gutierrez blog

Utah Standard Deduction 2022 Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. Officially, utah does not have standard deductions; Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. Web utah has a single tax rate for all income levels, as follows: Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. A listing of the utah individual income tax rates for various filing periods. Web utah standard and itemized deductions.

From learningfaunicznydi.z21.web.core.windows.net

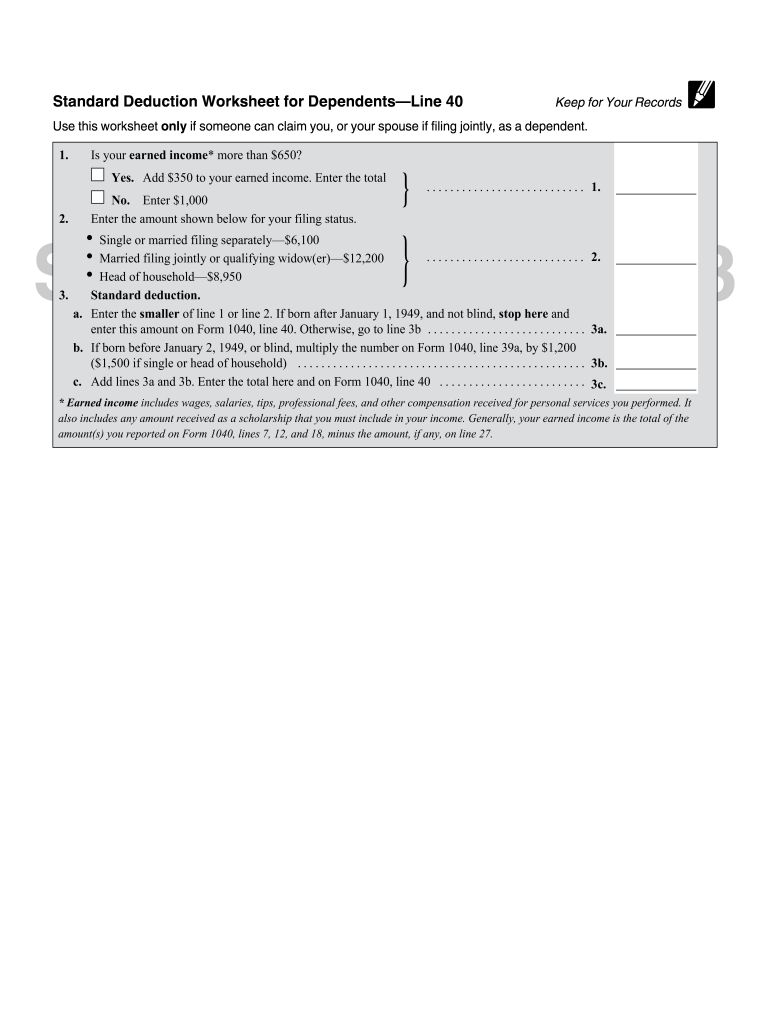

Standard Deduction Worksheets Utah Standard Deduction 2022 Web utah has a single tax rate for all income levels, as follows: Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. A listing of the utah individual income. Utah Standard Deduction 2022.

From giovannawdavina.pages.dev

New Standard Deductions For 2025 Sher Ysabel Utah Standard Deduction 2022 Officially, utah does not have standard deductions; Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. A listing of the utah individual income tax rates for various filing periods.. Utah Standard Deduction 2022.

From imagetou.com

Tax Deductions 2022 23 Image to u Utah Standard Deduction 2022 A listing of the utah individual income tax rates for various filing periods. Web utah standard and itemized deductions. Web utah has a single tax rate for all income levels, as follows: Officially, utah does not have standard deductions; Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. Web. Utah Standard Deduction 2022.

From charteredjournal.com

Tax Deduction at source from Commission 202223 Chartered Journal Utah Standard Deduction 2022 Web utah standard and itemized deductions. A listing of the utah individual income tax rates for various filing periods. Web utah has a single tax rate for all income levels, as follows: Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. Web if your total itemized deductions are less. Utah Standard Deduction 2022.

From deborbannamaria.pages.dev

Ut Vols Football Schedule 2024 Printable Pdf Averyl Elizabeth Utah Standard Deduction 2022 Officially, utah does not have standard deductions; Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Web utah has a single tax rate for all income levels, as follows: A. Utah Standard Deduction 2022.

From headtopics.com

Standard Deduction 20222023 How Much Is It and Should I Take It? Utah Standard Deduction 2022 Web utah standard and itemized deductions. Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. A listing of the utah individual income tax rates for various filing periods. Web. Utah Standard Deduction 2022.

From www.addify.com.au

The Standard Deduction 2022 Everything You Need to Know Addify Utah Standard Deduction 2022 Web utah standard and itemized deductions. Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. Officially, utah does not have standard deductions; Web •6% of federal standard deduction amount+ 6%. Utah Standard Deduction 2022.

From belchiosy5lessonlearning.z14.web.core.windows.net

Standard Deduction Worksheets Utah Standard Deduction 2022 Web utah has a single tax rate for all income levels, as follows: Officially, utah does not have standard deductions; Web utah standard and itemized deductions. Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. A listing of the utah individual income tax rates for various filing periods. Web. Utah Standard Deduction 2022.

From hindkunj.com

Standard Deduction 2022 IRS Hindkunj Utah Standard Deduction 2022 Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Officially, utah does not have standard deductions; Web utah standard and itemized deductions. Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. Web •6% of federal standard deduction amount+ 6%. Utah Standard Deduction 2022.

From www.pinterest.ca

Tax Deduction Worksheet Business tax deductions, Small business tax Utah Standard Deduction 2022 Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. Officially, utah does not have standard deductions; Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Web utah standard and itemized deductions. Web •6% of federal standard deduction amount+ 6%. Utah Standard Deduction 2022.

From youngandtheinvested.com

What Is the Standard Deduction? [2023 + 2024] Utah Standard Deduction 2022 Web utah standard and itemized deductions. Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. Web utah has a single tax rate for all income levels, as follows: A. Utah Standard Deduction 2022.

From susannewnoami.pages.dev

How Much Is Standard Deduction 2024 Vicki Jennilee Utah Standard Deduction 2022 Web utah has a single tax rate for all income levels, as follows: Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. Web utah standard and itemized deductions. Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. A. Utah Standard Deduction 2022.

From www.wsj.com

Standard Deduction 20222023 How Much Is It and Should I Take It? WSJ Utah Standard Deduction 2022 Web utah has a single tax rate for all income levels, as follows: Web on your utah return, your standard or itemized deductions are used in the calculation of the taxpayer tax credit. Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Web utah standard and itemized deductions. Web •6%. Utah Standard Deduction 2022.

From exoddlvhb.blob.core.windows.net

Standard Deduction 2022 For 65 Years Old at William Wilson blog Utah Standard Deduction 2022 Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. Web utah has a single tax rate for all income levels, as follows: Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. A listing of the utah individual income tax. Utah Standard Deduction 2022.

From cefpjdkt.blob.core.windows.net

Standard Deduction 2022 Business at Richard Gutierrez blog Utah Standard Deduction 2022 Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. Officially,. Utah Standard Deduction 2022.

From iolanthewailee.pages.dev

2024 Mfj Standard Deduction Rana Ursula Utah Standard Deduction 2022 Web •6% of federal standard deduction amount+ 6% of utah personal exemption •value reduces by $0.13 for each dollar the. Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. A. Utah Standard Deduction 2022.

From hedvigqcharlene.pages.dev

Standard Deduction For SelfEmployed 2024 carlin abigale Utah Standard Deduction 2022 A listing of the utah individual income tax rates for various filing periods. Officially, utah does not have standard deductions; Web utah has a single tax rate for all income levels, as follows: Web utah provides a standard personal exemption tax deduction of $ 777.00 in 2022 per qualifying filer and qualifying dependent(s),. Web utah standard and itemized deductions. Web. Utah Standard Deduction 2022.

From www.youtube.com

The Standard Deduction 2022 YouTube Utah Standard Deduction 2022 Officially, utah does not have standard deductions; Web if your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. A listing of the utah individual income tax rates for various filing periods. Web utah has a single tax rate for all income levels, as follows: Web utah provides a standard personal exemption tax. Utah Standard Deduction 2022.